-

Notifications

You must be signed in to change notification settings - Fork 2

KittieFIGHT Lending Tutorial

We have pivoted KittieFIGHT by integrating permissionless lending markets via decentralized Finance ( DEFI ), bringing an exciting passive income opportunity to Lenders. Lenders can now expect to earn Highly variable weekly interests of between 20% — 70% on capital committed to the internal KittieFIGHT treasury; “the Endowment fund contract”. The Endowment fund contract is completely opensource, user-controlled and accessible in our KittieFIGHT smart contract system.

The committed funds are then completely utilized in games as jackpots incentives, which MUST perform to return 10x its value in order for games to be ended and for profits/rewards to be distributed to winners and various actors such as lenders.

This new shift represents a tremendous leap forward over past setbacks in the form of changing market conditions and more recently pandemic causing global change everywhere. We are excited that the new functionality of providing passive income in the form of highly variable weekly interest to lenders via can be one small solution to global economic crises affecting most people everywhere.

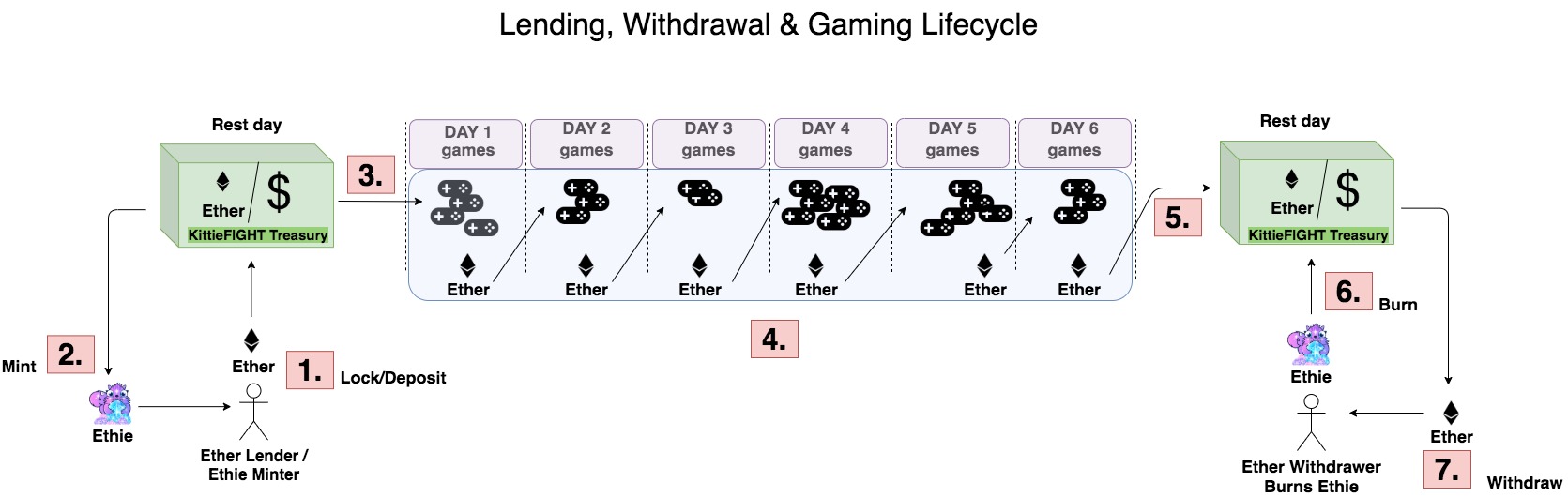

A lender can generate 20% -70 % rolling compounded interest in a periodical week following 4 major steps

- Lender locks Ether in KittieFIGHT treasury for at least an entire week .

- Lender generates an Ethie CDP .

- KittieFIGHT treasury( Endowment ) uses collective funds in games through the week .

- Lenders burn Ethie CDP during the rest day, to redeem compounded interest and Ether principal .

- Step 1: Lenders lock Ether which, thereby lending Ether to the KittieFIGHT treasury .

-

Step 2: Lender generates a Ethie CDP ( Collaterized debt position ) .

- Ethie CDP is held and used to receive weekly interest yield from KittieFIGHT treasury .

- Ethie CDP can be traded on opensea for the Future value of the Ethie CDP due to high weekly interest yield .

-

Step 3: KittieFIGHT treasury uses all deposited funds in weekly games as jackpot incentive for players .

- Multiple games are held weekly with each of the following conditions .

- Each game as an allocated initial jackpot from the kittieFIGHT treasury .

- Player groups battle each other betting Ether to win the game and attain top ranking to earn top profit . share .

- Each game can only end once; the final jackpot is 10 times(10x) the initial jackpot .

- Step 4: During the week, 10% of the final Jackpot of each game is recycled to other games .

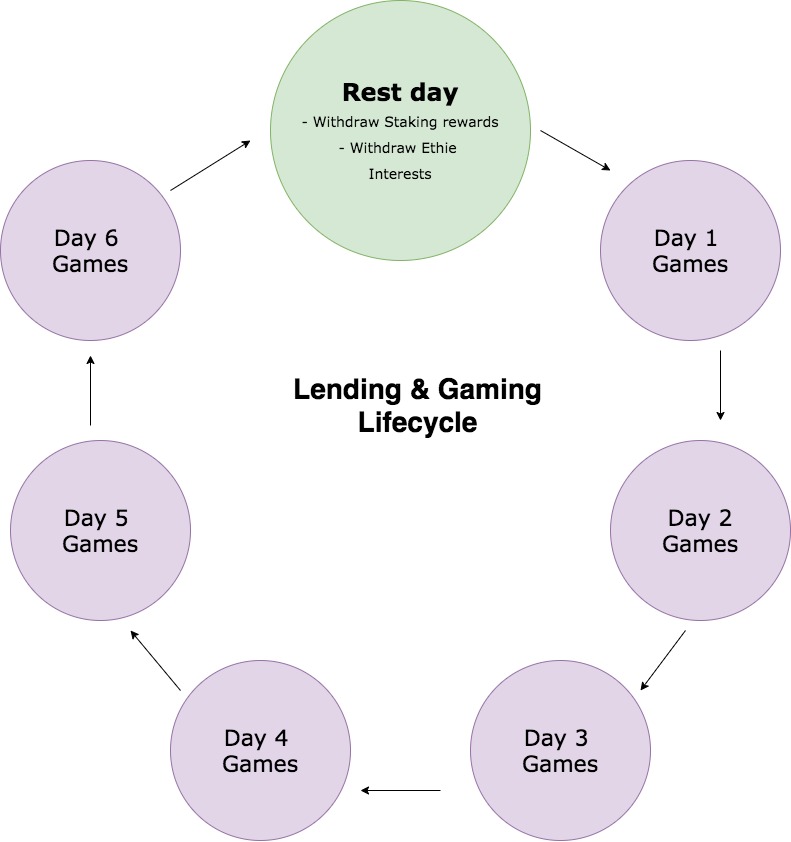

- Step 5: On each rest day, After the working days in the week, the accumulated interest is compounded and available for Lenders to withdraw .

- Step 6: Lenders can burn Ethie tokens to retrieve ETH principal and compounded interest accumulated over the week days .

- Step 7: Alternatively Lenders can hold on to Ethie and continue to accumulate compounded weekly interest .

- Step 8: ETHIE is tradable on any open marketplace like “opensea” for its “Future Value”. For example Lenders can sell ETHIE worth 10 ETH for 100 ETH or 200 ETH on opensea . This is possible because each week, a share of the cumulative Ether revenues from all the games held in a weekly period is distributed to ETHIE holders. Therefore any valuation process during a sale would consider the interest accumulated over a period of time .

Note : Also is important to note that DAO stakers collectively recieve 5% of Ether pool of all weekly funds, by staking DAO tokens.

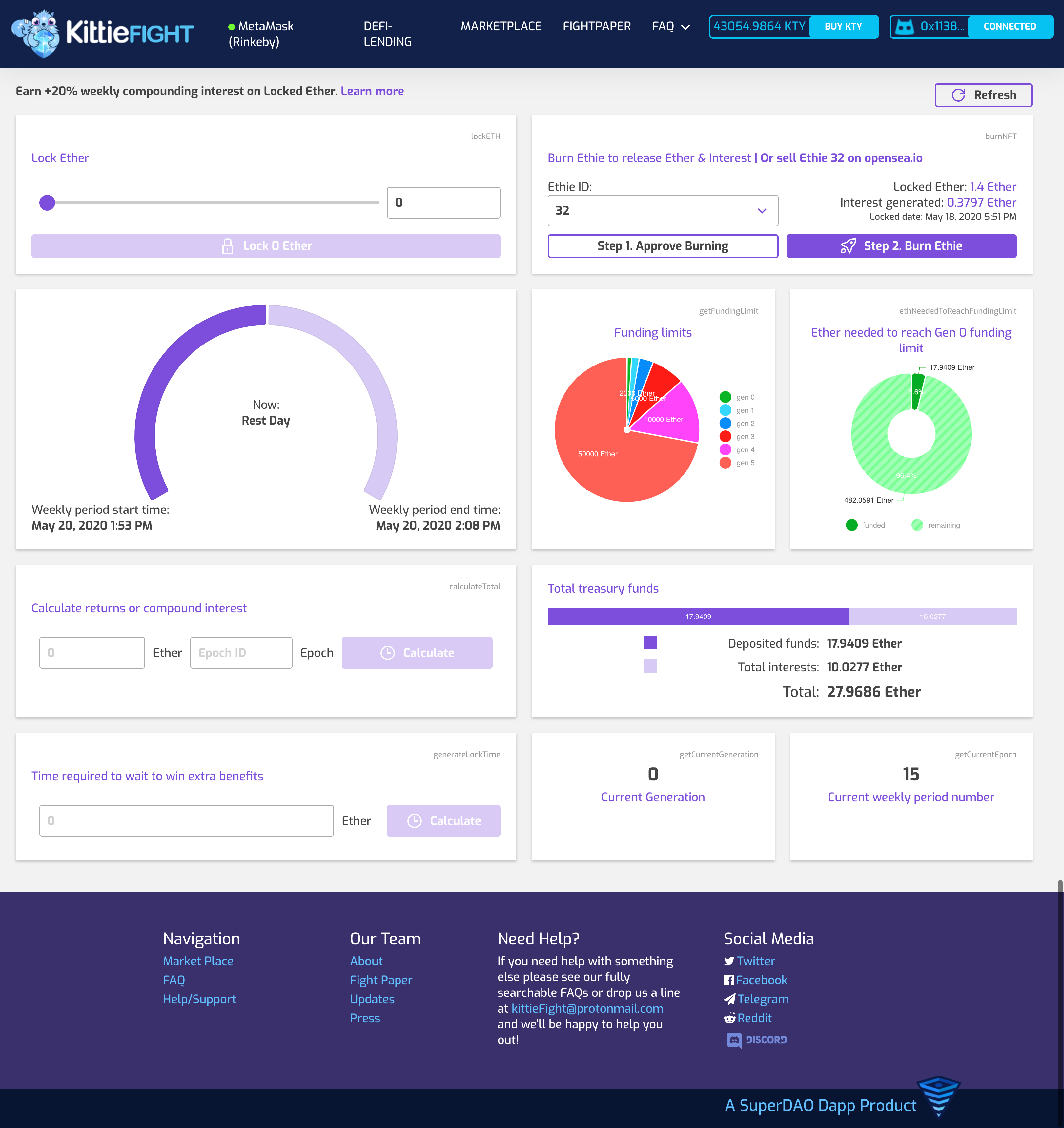

- Rest day

- Weekly period start time (or "Epoch stage start time"):

- Weekly period end time (or "Epoch stage end time"):

- Weekly period state (or "Epoch stage state"):

- Current weekly period number (or "Current weekly epoch number"):

- Next Interest claim date (or "Next yield claim date" ):

- CurrentGeneration :

- ReachedcurrentFunding limit :

- Total Interests :

- Lock Eth Date :

- Burn Ethie :

- Lock Ethie :

- Locktime :

- Calculate locktime :

- Calculate returns or compound interest :

- Funding limits of each generation :

- Ether needed to read current funding limit :

- Funding limits :

.

.